Fwt On Paystub: Decoding Federal Withholding Tax

You'll notice the line marked FWT on paystub. FWT stands for Federal Withholding Tax. This is one of the various codes and taxes withheld from your paycheck. These are taxes you need to know about to ensure financial clarity. So, what does FWT mean on my paycheck? Let's break it down.

It represents the portion of your income that your employer withholds from each paycheck. They send it directly to the Internal Revenue Service (IRS) on your behalf. This federal tax withholding is your prepayment of the annual federal income tax you owe.

Understanding these details is much easier when you use a pay stub generator. These documents clearly show each tax deduction and earning category. This article explains all you need to know about FWT on paystub. You'll understand what this means and how to calculate it. Let's get started!

- Understanding FWT Meaning on Paystub

- Why You Pay Federal Income Tax Withholding Tax

- How FWT Tax is Calculated

- Factors That Affect Your FWT on Paystub

- FWT vs. Other Pay Stub Deductions

- How FWT Impacts Your Year-To-Date Totals and Annual Taxes

- When and How to Adjust Your Federal Withholding Tax

- Closing Thoughts

Understanding FWT Meaning on Paystub

On any paycheck stub, FWT stands for Federal Withholding Tax. It is also known as Federal Income Tax Withholding. It is a mandatory deduction. Your employer withholds a portion of your earnings for the federal government. This process of income tax withholding is how most Americans pay taxes throughout the year.

What Is FITW on Pay Stub? FWT Deduction vs FITW/Fed Tax

You'll also notice that you see the term FITW on your pay stub. It stands for Federal Income Tax Withheld.

In other words, FWT and FITW mean the same thing. They both refer to the estimated federal income tax that your employer takes from your wages each pay period. Your employer's payroll department could label it as FWT or FITW paystub. Note that it means the same withholding tax.

Why You Pay Federal Income Tax Withholding Tax

The U.S. basically uses a "pay-as-you-earn" system for collecting income tax. How it works is that your employer withholds a portion from every paycheck. Therefore, you don't have to calculate and save payments each tax year. This spreads your tax liability across the year. In return, it becomes more manageable and ensures that the government has a steady stream of revenue. To put it simply, it acts as an installment plan for your taxable income.

A significant portion also goes toward funding the federal health insurance program. This refers to your Medicare and Social Security as part of your FICA tax deductions. With your FWT deduction, you're contributing to the federal health insurance programs.

Read more:Pay Stub Abbreviations. Everything You Need To Know To Understand Your Pay Stub

How FWT Tax is Calculated

You could calculate your Federal Withholding Tax using the information you have on your employee's Form W-4 and your gross wage. Your Form W-4 is your Employee's Withholding Certificate. This form has all the essential details. This includes your:

Filing status

Information on multiple jobs or a working spouse

Dependent claims

Any requests for additional withholding.

Employers use this information to determine the exact amount of Federal Income Tax to withhold from each paycheck. They'd have to check the IRS Publication 15-T. Publication 15-T contains the actual wage bracket and percentage method tables. It is used to figure the correct amount of tax to withhold:

Wage Bracket Method

This is a simpler, table-based method typically used for employees. This includes employees who have simple tax situations and earn under a certain threshold.

Percentage Method

This one is a more complex method for those who have more complex situations. It only applies to specific tax rates and portions of taxable wages.

Also check: Create your paystub within minutes with our checkstub creator.

Factors That Affect Your FWT on Paystub

You typically have several factors that could affect your FWT pay stub deduction. They include your:

Income Level and Gross Pay: This is the most direct factor. The U.S. has a progressive tax system. Therefore, this means that your tax rates increase when you earn more. When you get a raise, bonus, or overtime, it increases your gross pay. This means that you get a higher withholding bracket. Thereby, this increases your FWT. So when you work fewer hours as well, it could decrease it.

Filing Status Shown on Your W-4: Your chosen status, that is, "Single" vs. "Married Filing Jointly", uses different tables provided by the IRS. If you have a Married status, this typically results in withholding less per paycheck. Married filing jointly results in this due to wider tax brackets.

Tax Credits: If you claim any dependents or have any qualifying tax credits, it directly reduces your tax liability. You need to provide an account for these on your W-4. Therefore, this lowers the amount withheld from each check.

Major Life Changes: Even major events can affect your FWT. For example, getting married, having a child or getting divorced. It could also be your spouse starting or stopping their job. After these changes, you should then submit a new W-4 to ensure that you have accurate withholding.

Also check:W2 creator to instantly generate your W2.

FWT vs. Other Pay Stub Deductions

Your FWT is just one of the many mandatory and voluntary deductions on your pay stub. You need to understand the differences.

Mandatory FICA Taxes: Social Security & Medicare

These are separate from federal income tax. But they are also mandatory withholdings. They fall under the Federal Insurance Contributions Act (FICA). They include:

Social Security (OASDI): Social Security funds provide retirement, disability, and survivor benefits. The tax rate is 6.2% on earnings up to an annual limit. Your employer matches this 6.2% too.

Medicare Taxes: Medicare taxes fund the federal health insurance program for seniors. The tax rate is 1.45% on all earnings, with no cap. Your employer matches this 1.45%. High earners pay a 0.9% Additional Medicare Tax on income over a threshold.

State and Local Taxes

Most employees also see their state and local taxes withheld:

State Income Tax Withholding

Most states have an income tax. Your employer will withhold state tax based on your state-specific W-4 form. The nine states with no state income tax on wages are:

Alaska

Florida

Nevada

New Hampshire: It fully repealed its tax on interest and dividends for the tax year

South Dakota

Tennessee

Texas

Washington

Wyoming: Does not tax wages, but has a capital gains tax for high earners

Local Taxes

Some cities, counties, or school districts levy local taxes on income. These will also appear as a deduction.

Managing your state withholding may often require a separate form. It's a separate form from your federal W-4.

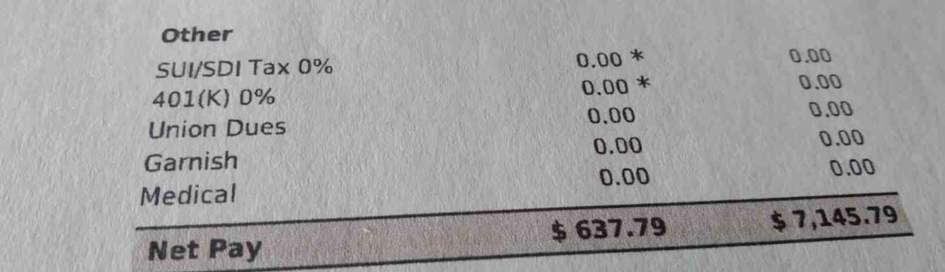

Other Common Deductions

This section includes voluntary or court-ordered deductions, like:

Employee Benefits: Post-tax premiums for life, dental, or vision insurance.

Retirement: Roth 401(k) contributions (which are post-tax).

Garnishments: Court-ordered wage garnishments for debts or child support.

Union Dues.

Read more: Pay Stub Examples: What A Real Pay Stub Looks Like

How FWT Impacts Your Year-To-Date Totals and Annual Taxes

Every January, your employer sends you a Form W-2. This reports your total annual earnings and the total federal taxes for the year. When you file your Form 1040 tax return, you calculate your actual total tax liability. It is based on your full year's taxable income, deductions, and credits.

You'd have to then compare your total tax liability to the total federal tax withholding. It's your FWT summed up for the year. This leads to either:

Tax Refund: If your employer withheld too much FWT over the year, the IRS owes you money. This leads to a tax refund.

Tax Bill: If you underpaid, that is, your employer did not withhold enough federal tax, you owe the IRS. This creates a large tax bill. It could also include penalties for significant underpayment.

When and How to Adjust Your Federal Withholding Tax

You only have to adjust your Federal Withholding Tax when needed.

When to Check Your Withholding

It's wise to check your withholding annually, but it's crucial after major life changes:

Starting a new job or earning additional income from a side job.

Getting married, divorced, or having a child.

Changes in your gross pay (a large raise or pay cut).

Purchasing a home (which can affect deductible interest).

Starting a new tax year, tax rates and brackets often adjust.

How To Adjust Your FWT Tax Deduction

To adjust your federal withholding, you must submit a new Form W-4. Submit it to your employer's payroll department. You need to fill out Steps 2-4. These steps accurately reflect your filing status, multiple jobs, dependents, and other deductions/income. The changes will be reflected in your next full pay period.

Read more: Understanding Pay Stub Deductions

Closing Thoughts

FWT meaning federal withholding tax, when understood, can help you ensure your pay is accurate. However, you don't have to figure it out alone. Reviewing and adjusting your W-4 form helps a lot. For employers, making sure withholding is accurate is also necessary. Make sure you review, correct, and update your W-4 and last paycheck stub. This makes it easy to figure out the right tax to withhold from each paycheck. This can help keep a business compliant and ensure satisfied employees.

With a paystub creator, it is easier to understand your income. Our AI pay stub generator also helps to simplify this process. These tools show your FWT on paystub and other deductions. Get started with us today!

Our customer support is available 24/7:

Our customer support is available 24/7: