Limited-time offer! Get a free paystub when you purchase another 3 paystubs with the PayStubCreator.

Take advantage of our incredible Free Paystub Generator offer: purchase three paystubs through PayStubCreator, and we'll give you a fourth paystub completely free. That's 4 stubs for the price of just 3.

>> Claim your free paystubs here <<

This straightforward deal comes with no strings attached: no subscription required, no software to download, and absolutely no hidden fees. This offer applies a 25% discount to your cart when you buy 3 pay stubs.

Enter your

information

Preview

your stub

Download

your stub

4.4 out of 5.0 stars on 717 reviews

Ready to create a paystub for free? The process should be straightforward:

The entire process should take under 3 minutes with our free paystub creator tool.

Free pay stub makers are great for occasional, personal use, especially if you don’t need advanced calculations or guaranteed acceptance by banks or agencies.

Paid generators are essential if you:

Need guaranteed accuracy and compliance

Regularly generate multiple pay stubs (ideal for contractors and small businesses)

Want advanced features like complex tax calculations and priority support

Care about your documents being accepted for official purposes

Pro Tip: If you’re spending hours troubleshooting a free tool, a paid solution pays for itself in saved time and peace of mind.

When evaluating a free paystub generator with no watermark, ask these key questions:

Does it handle your state's tax requirements? Tax laws vary significantly by state, so your generator must be current with local regulations.

Steer clear of generators that:

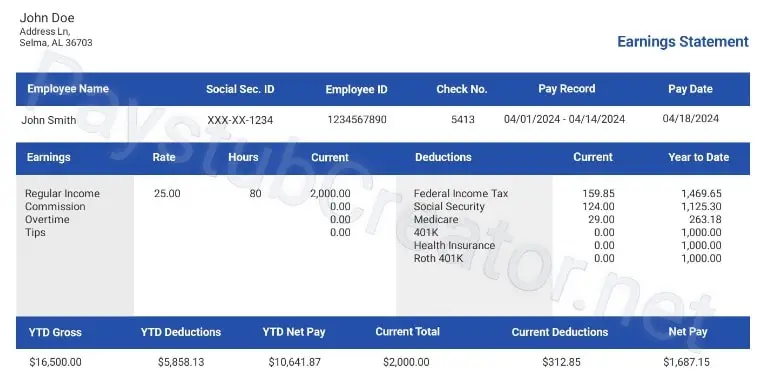

A pay stub, or paycheck stub, is a document that provides a detailed breakdown of an employee's gross earnings, net pay, and all deductions for a specific pay period. While it's often a small slip of paper attached to a physical check, it's also commonly an electronic document available through a digital portal. This document is a critical record for both employees and employers.

For employees, a pay stub offers transparency, showing exactly how their gross salary transforms into their take-home pay. It itemizes deductions for federal, state, and local taxes, Social Security, and Medicare, as well as contributions to retirement plans, health insurance, and other benefits.

For employers, pay stubs are a necessary part of payroll management. They ensure compliance with labor laws, which in many states require providing this information. They also serve as an important record in case of wage or tax disputes. Even in states where pay stubs aren't legally mandated, the Fair Labor Standards Act still requires employers to maintain detailed records of hours and wages.

Our free offer gives you an extra pay stub at no additional cost, but we never compromise on accuracy or professionalism. When it matters most (like for tax filings, loan applications, or employee records), investing in a trusted pay stub generator is worth it.

It's simple. Imagine spending 5 hours wrestling with a free paystub generator tool to get the calculations right, versus 2 minutes with a premium solution. The paid version pays for itself quickly.

Additionally, when handling important financial documents, the peace of mind that comes with professional-grade accuracy is invaluable.

Having an accurate pay stub is more important than you might think. Beyond simply showing what you were paid, a pay stub serves as a formal proof of income. This is essential for a wide range of financial applications.

Think about the last time you applied for a loan, a mortgage, or even a new apartment. Lenders and landlords require verification of your income to assess your ability to repay a loan or pay rent. A professional pay stub is often the preferred document for this purpose. It provides a clear, structured record that is easy for financial institutions to verify. In contrast, simply showing bank statements can be a red flag, as they don't provide the detailed breakdown of gross earnings versus deductions that a pay stub does.

For freelancers and independent contractors, the importance of a reliable pay stub is even greater. The gig economy has created a huge number of self-employed individuals who often don't receive traditional pay stubs from clients. However, they still need to prove their income for loans, rent, or even filing their taxes. A paystub generator can be a game-changer, allowing them to create legitimate, professional-looking records that accurately reflect their earnings and expenses, such as self-employment taxes or business-related deductions. This helps them bridge the credibility gap often faced by those without a traditional W-2.

Do you need a W-2 Form? Use our Online W2 Generator for the most accurate W2 Forms.

Ensure accuracy and compliance with state-specific pay stub details. We've gathered crucial information for the top US states; simply click on your state to find local requirements and guidelines. California, New York, Texas, Florida, Ohio, Pennsylvania, Illinois, Georgia, North Carolina, and Michigan.

Whether you're an employee, a freelancer, or a small business owner, having access to an accurate and professional pay stub is non-negotiable. It's an essential tool for financial management, legal compliance, and establishing credibility. While free tools can be useful for simple, one-off needs, a paid solution provides the peace of mind that comes with accuracy, security, and a wide range of features.

Ready to see how easy it is to generate your own professional pay stubs? Take advantage of our limited-time offer and get your first one free when you purchase three others.

Fill out our contact form, and we will get back to you as soon as we can!

Contact usHi! How can I help you? Kris