What Are The Differences Between A Pay Stub Vs Payslip?

Your pay stub is also known as your payslip, paycheck stub, or salary slip. It is the document you get with your paycheck. It's a detailed receipt that your employer gives to you. This document breaks down your total earnings and deductions for a specific pay period.

You may, however, be wondering if there's any difference between a pay stub vs payslip. People use these terms interchangeably, so it could be confusing. As a worker in the U.S., you should understand what these terms mean. If you're looking to create your document, you can use a paystub generator.

This guide will explain payslip vs pay stub, so you'll fully know if they're different or the same. It also shows you how to read and use your pay stubs or payslips.

Understanding Your Earnings Statement

Your earnings statement explains your employee earnings and deductions.

What Is a Paystub or Pay Stub?

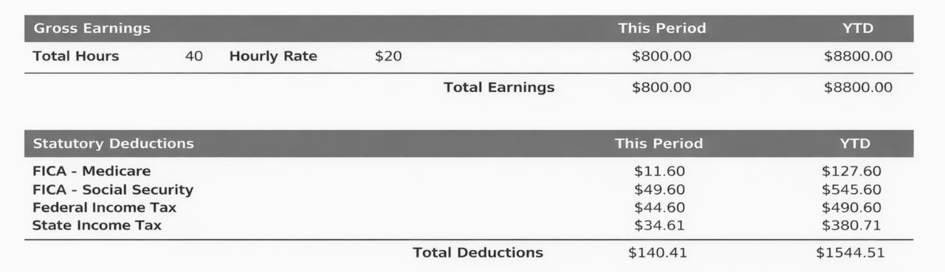

A pay stub is a detailed record of your employee's compensation for a given pay period. It outlines your gross earnings, net pay, and all of your deductions. This could include deductions like your federal income tax and state income tax. It can also be your FICA taxes (Social Security and Medicare), health insurance premiums, and retirement plan contributions.

Your employer or payroll department creates your pay stubs and provides them to you. They can either give you physical copies or your electronic pay stubs. Using electronic pay stubs is now even more common, although some people still prefer to use their physical pay stubs. You can access it by logging in to your company's portal. You'll find it in the pay section of your profile.

Pay Slip Meaning: What Is Payslip?

So, what is a pay slip? A pay slip is typically the same as a pay stub; they just have different names. Your pay slip is also a document that breaks down your pay. Using these terms depends on where you are.

Most people prefer to call their pay statements a "payslip". This is the preferred term in countries like the UK, Australia, and other Commonwealth countries. Whether you call it a pay stub or pay slip, it still serves the same purpose. It helps you understand what you earn clearly.

Read more: Understanding Paycheck Acronyms On Your Paystub

Pay Stub vs Payslip

As already mentioned that your pay stub and payslip mean the same thing. They are the same document, which is a statement of your total earnings and deductions. It simply informs you about your income details.

However, while they're the same, there are still slight distinctions between a pay stub and payslip. In the USA, the document is referred to as a pay stub or paycheck stub. This is quite the standard here. In the UK and some other places, people refer to it as a payslip or salary slip.

Also, it's normal for companies to have their preferences. Some companies use pay stubs. Meanwhile, some other companies prefer to use the term "payslip". Regardless, both of them should provide a full breakdown of your earnings.

Note that this document is not the paycheck itself. Your paycheck is the actual check or your transaction for direct deposit. Your pay stub follows your paycheck.

So, is a payslip the same as a pay stub? Yes, it is.

Also check: Check out our free pay stub template.

What Information Is Included on Your Pay Stub?

On your pay stub or pay slips, you'll typically find your earnings breakdown. Here is some of the information that you find on your pay stubs:

Employee and Employer Details

This includes your name, address, and employee identification number. It also lists your employer and company details. This includes your company's legal name and address. This confirms the employment relationship.

Pay Period

This refers to the specific pay period covered.

Employee's Gross Pay / Gross Income

This is your total income before any deductions are made. It includes your basic salary or wages.

Deductions and Withholdings

This includes your taxes withheld. They are mandatory payments you make to the government. They include:

Federal Income Tax

State and Local Taxes (not all states have state income tax)

FICA Taxes: This mandatory deduction funds Social Security and Medicare.

They also include your insurance and benefits. It's your share of your employer-provided benefits. It includes:

Health Insurance premiums: Medical, dental, vision.

Retirement Contributions: Like 401(k) or pension plan payments.

Other Deductions: These can include voluntary items or court-ordered ones.

Union dues.

Wage garnishments: Includes payments for things like child support or student loans.

Additional Earnings

This is where your overtime pay, bonuses, commissions, and other incentives are listed. It's part of your employee's gross earnings for that period.

Employer Contributions

This refers to the portion your company pays for benefits.

Net Pay / Net Income / Take Home Pay

This is the actual amount that your employer deposits into your employee's bank account. It's what's left after you subtract all your taxes withheld and other deductions from your gross pay.

Year-to-Date (YTD) Totals

This column shows your total gross income, deductions, and net income from January 1st to the current date. It prepares you for budgeting and for preparing your annual tax obligations.

Also check: Create W2 Form online now.

Why Is Your Pay Stub or Pay Slip Important?

Your pay stub is really important for you as a worker or employee. Here's what it does:

As a Proof of Income Document

Lenders, landlords, and even government agencies use your recent pay stubs as proof of income. It verifies your financial stability. It helps to secure your personal loan or mortgage. It also helps with proof of income for rental applications. Landlords want proof you can afford the rent. This is why they request your proof of employment and income.

Transparency and Record-Keeping

By reviewing each pay period, you can verify what you earn. This includes your hourly wage, overtime pay, and all applicable deductions. This also helps you budget for the future. You can then be able to make better financial decisions.

Tax and Compliance

When it's tax season, your pay stub is highly important. It shows all your taxes withheld throughout the year. This makes it easy to review with your W-2 form. You can use the information on your pay stub if you lost your W-2 form. It can help with tax compliance and ensure accurate filing.

For employers, providing this wage statement is often a legal requirement. It's under state laws in certain states. It's a record that proves they are meeting minimum wage and overtime rules.

Read more:State Laws Pay Stub Requirements: What You Should Know

How To Access Your Pay Stubs or Pay Slips

If you need a copy of your pay stub or payslip, here's how to get it.

Company Portal: Simply log in to your company's payroll or HR system. This way, you can access your electronic pay stubs.

Direct Deposit Advice: If you use direct deposit, your bank might provide a digital deposit advice note in your transaction history. This sometimes includes your stub details.

Physical Copies: Some companies still provide printed pay stubs. They are usually included with paper checks. They sometimes make them available in their central office locations.

If You Can't Access Your Paycheck Stub

Formal Request to HR/Payroll: Simply ask. Contact your payroll department or HR representative. They can usually provide printed or digital copies.

Using Bank Statements: While this is not a substitute, using direct deposit amounts that are shown on your bank statements can help. It can serve as supplementary proof of income. The only thing about this method is that they don't have detailed deduction info.

For Self-Employed or Independent Contractors: If you don't get a stub from a client, you may need to create your own using any reliable accounting software. You can also use a professional pay stub generator for your records.

How Payroll Processing Works

You may be thinking of how companies or organizations create this document. They do this through payroll processing. Payroll begins with W-4 information for federal tax withholding, along with timekeeping data and benefit elections from separate systems.

Modern payroll software then automates the complex calculations. It applies the correct tax system rules, including federal, state, and local taxes. It also calculates FICA taxes, subtracts health insurance premiums and retirement contributions, and accounts for overtime pay rates. This automation minimizes errors in calculating your gross salary and net salary.

Accurate payroll records ensure employee trust. They're important for adhering to federal laws and tax regulations.

Read more: What Are Payroll Warrants?

Final Thoughts

So, is it paystub or pay stub? At the end of the day, whether you call it a pay stub or payslip, this document is still useful for your finances. It ensures transparency and tax compliance. This is why you need to understand this document. Know your gross, net pay, and every deduction you have. Also, make it a habit to review this statement every pay period. File your electronic pay stubs securely or store the physical copies.

If you need to generate a professional, accurate pay stub for your records, create a pay stub here easily. It's simple and easy, and it only takes a couple of minutes. Get started with us now.

Our customer support is available 24/7:

Our customer support is available 24/7: