What Type Of Information Is Required On Pay Stubs?

If you're an employer, taking care of your employees is the best way to ensure the success of your business. That means providing your workers with an accurate account of their pay. Almost 100 percent of employees in the US now receive their pay via direct deposit. This can lead to complacency from both parties when it comes to pay stubs and the information they contain.

Understanding items on a pay stub benefits you, your employees, and your business. Not only does it make the process smoother if an employee leaves, but potential mistakes are also easier to spot. This can avoid problems with the IRS and conflicts with employees. Read on to find out what information you need to include on an employee pay stub.

What Are Pay Stubs?

As we explain in our guide dedicated to answering the question, "what is a pay stub?", a pay stub is proof of payment to an employee. A pay stub itemizes an employee's pay for that period as well as their year-to-date total. The pay stub also details deductions taken out of an employee's earnings, such as tax. A pay stub also shows the amount the employee takes home as net pay.

A pay stub can come in both paper and electronic form. Different states have different requirements as to whether employees receive their pay stubs on paper or not.

What Is A Pay Stub Used For?

A pay stub includes information for both employers and employees. For employees, a pay stub serves as a record of their wages. By reviewing the information it contains, employees can ensure they were paid correctly and understand their deductions. Employees may also need their pay stubs to secure a rental contract or loan, or for compensation claims.

For employers, an excellent pay stub record makes it easier to resolve pay discrepancies. You can also use the information in a pay stub to complete each employee's Form W-2 when doing your taxes.

What Information Is Required on A Pay Stub?

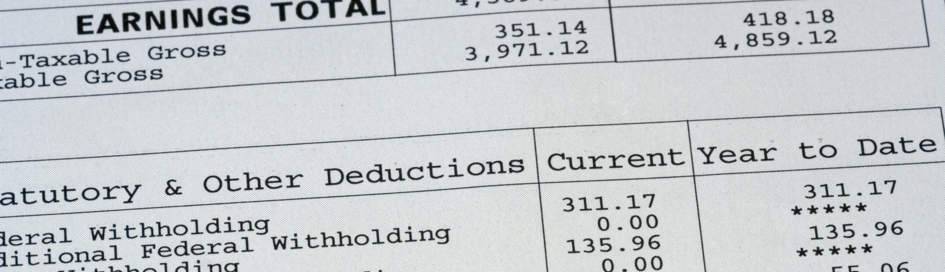

As you'll see on our pay stub example templates, an employee pay stub needs to include basic employer and employee information. This includes details such as the company name and operating state, as well as the employee's name and social security number (SSN). All other mandatory information on a pay stub is related to payments and deductions. These items on a pay stub are:

- Gross pay

- Taxes, deductions and contributions

- Net pay

To understand what each of these involve and include, here is an in-depth guide on these items.

1. Gross Pay

Gross pay is the total amount paid to your employee before deductions are taken out. You will calculate gross pay differently, depending on whether the employee is paid a yearly salary or an hourly rate. Information about gross pay, for both salaried and hourly workers, appears in two separate columns. One column shows the gross pay for that pay period, e.g. this month.

The second column provides the employee's year-to-date totals. The following information itemizes the total gross pay amount:

Hours Worked

An hourly worker's pay stub includes the number of hours worked. This information is crucial for them to ensure that they have been paid for the correct amount of hours during that pay period. The number of hours worked may also appear on the pay stub of a salaried worker. A non-exempt employee can work different types of hours, including regular, overtime, and double time.

Their pay stub should show each type of hour worked on a separate line to avoid confusion.

Pay Rate

An employee's pay stub should also include their pay rate. Hourly workers may receive different pay rates for their regular hours, for overtime, or for working holidays or nights. In the case of a salaried employee, the pay stub can include the pay they are owed for that period worked.

Additions

As well as regular wages relating to hours worked, employees may earn additional income. This can include holiday pay, personal time, bonuses, and advances. If there are any additions these should all appear on separate lines.

2. Taxes, Deductions, and Contributions

A pay stub also itemizes the deductions taken from employee earnings. Like gross pay, a pay stub also lists the deductions for that pay period as well as for the year-to-date. The deductions are often the most complicated part of a pay stub. This is because different states have different tax requirements and deduction codes aren't always clear.

By understanding the deductions and taxes your employees pay, you can help them decipher their pay stub information and check for accuracy.

Taxes

These include federal income tax, the employee portion of social security tax and, sometimes, state and local income taxes. The amount of federal tax an employee will pay depends on their tax bracket. This can be from 10 percent to 37 percent. How much an employee pays depends on how much they earn.

State tax varies per state, while some have no state income tax at all. State taxes can be complicated for workers who live and work in different states. Some areas, such as New York City, set their own local taxes to pay for government services.

Other Deductions

This can include an employee contribution towards insurance premiums or retirement plans. Charitable contributions and payments towards loans may also show within the deductions on a pay stub.

Employer Contributions

Although employer contributions appear on an employee pay stub, they are not deducted from their gross pay. These reflect the amounts that you contribute as the employer. These include FUTA and SUTA tax, and the employer portion of social security tax.

3. Net Pay

Net pay, which is also known as 'take-home pay,' is the amount that employees receive in their bank, or in their paycheck. Net pay is the amount left after the deductions have been subtracted from the gross pay. The pay stub will include both the net pay for that pay period and the year-to-date net pay that the employee has received.

Your Guide to The Information Required On Pay Stubs

Here at PayStubCreator we're dedicated to making your life easier by providing a fast, secure and convenient way to create your own pay stubs. Thanks to this guide you should now be clear about what information a pay stub is required to contain. Are you ready to create one? Get started with the paystub maker now and experience how quick and easy it is! As a small business owner, we're also letting you in on tips how to become financially stable during the pandemic and how to draw the line between business and hobby when it comes to earning money. In addition, if you're paying your employees electronically, you may want to do it correctly and avoid the unwanted in the future.

Our customer support is available 24/7:

Our customer support is available 24/7: