What Is A Void Check And How To Obtain One?

You may be asking, "What is a void check?" A voided check is a check that indicates you cannot use it to make payments. If an employer or financial institution asked you to provide a voided check and left you puzzled, you're not alone. This is actually a common request. However, most people do not really understand what this is. They may also not understand where and how to obtain it.

In this guide, we'll explain the meaning of voided check and why you may need it. We'll also walk you through the process of getting and writing one. With this, maintaining consistent pay records can be done with a pay stub generator to generate pay stubs. They create pay stubs that match your checking account details.

Understanding Voided Check Meaning: What Is a Void Check?

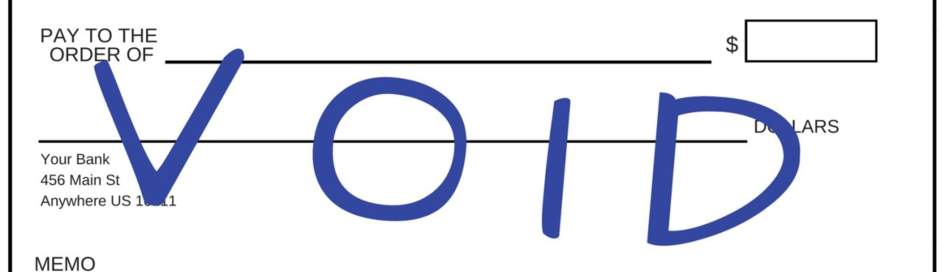

A voided check is simply a check that has the word "VOID" written on it. Therefore, it cannot be cashed or deposited. But why would you want to make a check completely unusable? As it turns out, voided checks also have a significant role in our financial system.

When you void a check, you are giving out bank account information in a safe way. This measure prevents that particular check from being used to withdraw money from your bank account. The written word "VOID" on a check serves as a protective measure. This makes it impossible to cash the check even if it falls into the wrong hands.

You may also hear the term "pre-printed voided check." So, what is a pre printed voided check? This typically refers to a counter check or a document that you print directly from your bank or a digital service. It has "VOID" marked on it. It contains your pre-printed account information.

Read more: What Is Advice Number On Pay Stub?

When Do You Need a Voided Check?

There are several instances where you may need a voided check, including:

1. Setting up Direct Deposit

When starting a new job, you may choose to receive your paycheck through direct deposit. Your employer may ask you to provide a voided check for direct deposit setup. This gives them all the necessary banking information. This includes your account and routing numbers that are found on the check. This is a major reason that answers, "Why do some companies need a void check?"

2. Automatic Payments

You may want to set up automatic bill payments for bills like utility bills or mortgages. In such instances, the company may request a voided check. This is to be sure that they have the correct account details. This facilitates electronic payments and ACH transfers.

3. Correcting Mistakes Filling Out Checks

Mistakes happen. You can make a mistake filling out a check, such as writing the wrong amount or account number. If this happens, voiding the check is the best way to show that the check is not intended for any transaction. It cancels the check, preventing money from your account from being sent incorrectly.

4. Electronic Payments / Transfers and Linking Accounts

There are some financial institutions that may need you to provide a voided check. This enables them to set up electronic transfers of funds from one account to another, or to link bank accounts.

5. Verification of Bank Account Information / Banking Information

Sometimes, service providers or government agencies may need to verify your account information. For example, when you're applying for a loan or opening a new investment account. A voided check ensures they have a guarantee that you own the bank account. It also ensures that the information you entered is correct.

Also check:Use our AI pay stub generator to create easy pay stubs.

How To Get a Voided Check

There are several ways to get your hands on a voided check, some of which are explained below:

Use Your Checkbook: The easiest way to get a voided check is to take a blank check from your checkbook. Then, write "VOID" in large letters. Ensure the writing does not cover the banking details at the lower part of the check.

Request from Your Bank or Credit Union: If you don't have a checkbook, you can apply for a counter check or temporary check. They can be voided at your bank. Sometimes, the bank or credit union offers this service for free. Other times, they may charge a small fee.

Through Digital Banking: Some banks' online banking portals now allow customers to log in. Then, you can print a voided check. Go to the website or application associated with your bank. Search for this feature under the relevant options. These can be options such as account services or check ordering. Digital banking solutions provide a convenient alternative. Not all banks offer this.

Use a Starter Checking account: If you have just created a new account, then you probably have received starter checks. These can be voided just as any normal check can be.

Read more:Understanding How To Get Pay Stubs From Direct Deposit

How To Write a Voided Check Using a Blank Check

Voiding a check is a simple process, but it is also essential to do it the proper way. This ensures no one will be able to cash the check again. Follow this step-by-step guide to void a check correctly:

Get a blank check from your checkbook.

Use a blue or black ink pen that's permanent. Don't use pencils or any ink that's erasable.

Write "VOID" in capital letters across the front of the check. Write void in large letters so it's clear.

Ensure that the writing does not hide the bank account information at the lower part of the check, specifically the routing number and bank account number.

You can also write void in smaller letters. Write it in the date line, payee line, amount line, amount box, and signature line.

Note the check number of voided checks in your check register. This is for future reference. It helps you to keep track of it, and you'll remember that the check was voided.

Remember, there is no need to enter any other information on the check, namely date, payee, or amount. Also, if you use duplicate checks, be certain that the word VOID is visible on the duplicate as well.

Lastly, you should always avoid giving someone, especially the wrong person, a blank check. This is because anybody can just fill it out and have funds automatically withdrawn from your bank account. A good rule of thumb to keep in mind is to treat checks like cash.

Alternatives to a Voided Check

While void checks are commonly used, there may be situations where you don't have access to one. In those situations, here are some possible alternatives:

Direct Deposit Authorization Form: This depends on the requesting organization or employer. Some employers and organizations may give you their own direct deposit bank account form. You can just fill in your correct banking information.

Bank Letter: The bank can give you an official letter showing your account details. This does the same job as a voided check.

Deposit Slip: A deposit slip contains much of the same information as a check. It can also be used in place of a voided check for many applications.

Always find out from the requesting party which of these alternatives they accept. Then, you can go ahead to provide the required documents.

Also check: Looking for a W2 maker to create your W2 form? Generate your document now.

Common Mistakes To Avoid and Tips for Voiding a Check

While providing a voided check is generally safe, you still need to protect your sensitive information. Here are some tips to keep your details secure and prevent identity theft:

Only give out these checks to persons and organizations you trust.

Ensure that you keep a record of all those to whom you have given voided checks.

Review your bank statements regularly to check for any activity you did not initiate or authorize.

If you have any questions about a request for the check, then you should contact the organization.

When disposing of old paper checks or voided checks, use a paper shredder.

Read more: What You Should Know About Biweekly Vs Semi-Monthly Pay

Closing Thoughts

Knowing "What is a void check?" and how to use it is all part of managing your personal finances. Remember, a voided check is a document that provides a means of sharing your banking details. By following the guidelines mentioned, you can provide a voided check when necessary. You'll also ensure that your bank account isn't tampered with while at it. So the next time you're asked for a voided check, you'll know what to do.

Using a pay stub maker can also help you stay consistent with your payment records. Stay ahead of your finances using our tool today!

Our customer support is available 24/7:

Our customer support is available 24/7: