What Is Advice Number On Pay Stub, And Is It The Same As Direct Deposit Advice?

Advice number is a unique identifier that tracks payroll transactions. This number allows employers, employees, and banks to verify electronic transfer of funds.

You may have looked at your pay stubs and asked, "What is advice number on pay stub?" or "What does advice date mean?" For individuals who need to create pay stubs, it's important that they know what they mean.

This guide explains "What is advice number on pay stub?", and what the direct deposit advice and VCHR number are. You'll learn where to find them and how to use them to verify a payment.

What Is Advice Number on Pay Stub?

Advice number is a unique reference number or transaction ID. It is usually assigned to your payroll payment. You might also see it labeled as a VCHR number, which it’s payroll abbreviation is short for voucher number. The company payroll or the bank's processing system generates this. Typically, you can find this on your pay stub or payment advice slip, especially if you know how to read a paystub. It serves as a reference number that helps employers, employees, and banks track the transfer of funds.

Where Can You Find the Advice Number on Your Pay Stub

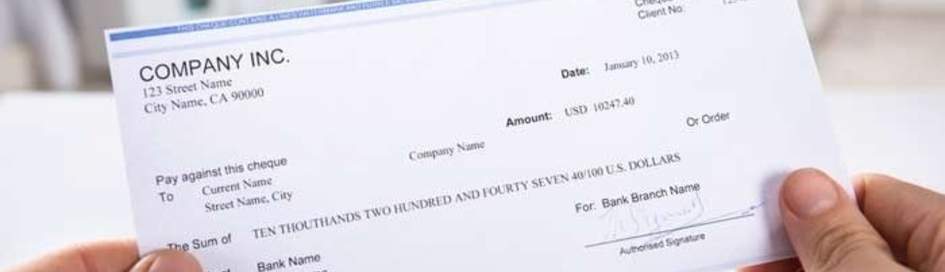

Check the header section of your pay stub to find your advice number. It is usually close to the pay date or check number on the pay stub, which is at the top corner. In digital direct deposit advice statements, it’s always in a location similar to this or within the transaction details line.

If you make use of a payroll portal, check alongside your deposit date and net pay amount. If you can't seem to access it, ask your company's payroll department to tell you where it is.

Read more: Differences Between A Pay Stub Vs Payslip?

Advice Date Meaning on Your Paycheck

Advice date refers to the day you officially get paid, which is your pay date. This refers to the day that your employer issues your paycheck and releases the funds. If you make use of direct deposit, this is when the money reaches your account.

It's very important to know your advice date as an employee. It assists with planning your finances clearly. An advice date also allows you to manage your budget. You’ll know exactly when your income will arrive. This way, you can be able to plan how to spend your bills and expenses. It also helps if you need to verify a payment hasn't arrived on time.

What Is a Direct Deposit Advice?

In essence, direct deposit advice is the digital version of your paper pay stub. If you receive your salary electronically via direct deposit, this is what you’ll receive. This will be your proof of payment that has been deposited. It contains all the same information as a regular stub. This includes your gross pay, the pay deductions, net pay, pay period, advice date, and the advice number.

You can access it through your company's payroll portal. You can also receive it through email or find it in your online banking account history.

Also check:Create professional paystubs in minutes with our easy-to-use templates.

Advice Number vs. Check Number

These two are similar but not the same thing. They handle different kinds of payments. An advice number is the one used for electronic money transfers, such as direct deposit. It is the key reference number for electronic money transfers.

On the other hand, a check number is the sequence number that is normally imprinted on physical checks. This will allow check transactions to be tracked.

Therefore, here is what you should know. If you receive payments directly deposited into your account, you'd use the advice number as the main point of reference. If you receive payments in the form of a paper check, the check number would be used as the main point of reference. However, there would still be an advice number contained in the payslip or pay stub.

Also check: Do you need your W2 form for taxes? Use our W2 Generator.

Why the VCHR Number Is Important

Here are a few reasons why an advice/VCHR number is important:

Verifying Payments and Tracking Income

The advice number allows you to confirm that you've received your pay. You can use the advice number to track the specific transaction in your bank statement. This makes personal record-keeping and income management much more efficient.

Resolving Payroll Discrepancies

If there's ever an error in any payroll transaction, you can use the advice number to track the transaction. It could be errors like missing a payment or having an incorrect amount. An advice number is a vital tool. You need to provide this number to your employer or payroll department. They'd use it to find the exact transaction in their system in order to resolve the issue.

Read more:Pay Stub Examples: What A Real Pay Stub Looks Like

How To Use Your Advice Number to Verify a Payment

If you need to confirm or monitor a transaction, here's how:

Locate the Details: Find the advice number and advice date on your direct deposit or paycheck.

Check Your Bank Account: When it is close to your advice date, you can log in to online banking. There, you can look for an entry that equals your net pay.

Initiate an Inquiry: If the money is not available, you need to get in touch with your company's payroll office or personnel department. You will need to provide your name, the date of the advice, as well as the advice number.

Follow Up With Your Bank: Once your employer has verified that you did send a payment, you should then contact your bank. You can provide them with your advice date, advice number, and deposit amount. This is so that they, too, can track your electronic deposit in their system.

Read more: What Is Direct Deposit Vs Physical Paycheck?

In Summary

You should really understand the advice number and advice date on your pay stubs when you work as an employee. They will enable you to check your payments and track your income. Additionally, in a situation where there is a concern related to payments, an advice number is useful.

Employers, freelancers, or small business organizations that require a pay stub can now create professional pay stubs. Use our check stubs maker to allow for seamless record keeping and compliance. Get started with us now!

Our customer support is available 24/7:

Our customer support is available 24/7: