Pay Stub Examples: What A Real Pay Stub Looks Like

Pay stub examples illustrate what an actual employee pay stub looks like as well as the sections it contains. Real pay stubs help employees to see how their gross pay is converted into net earnings. It also helps understand details like taxes withheld, hours worked, and YTD totals.

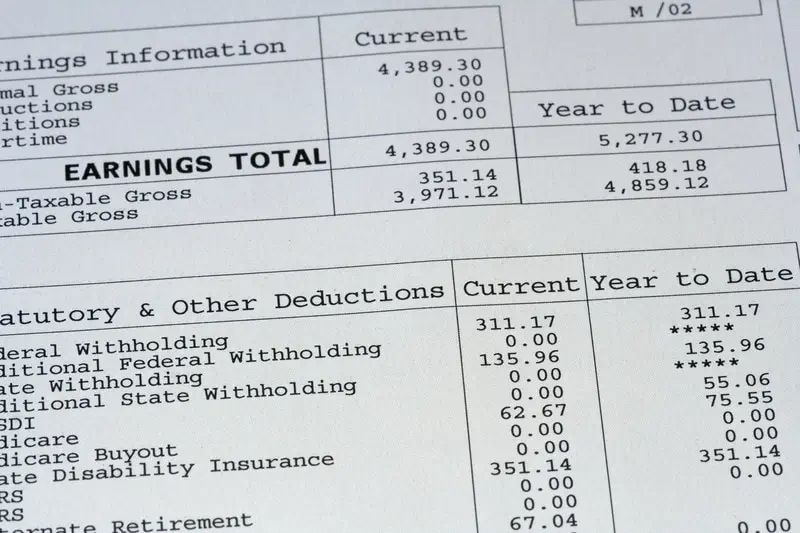

This article explains what pay stubs are and why they are important. It also provides examples of pay stubs with pay stub images. These pay stub images show what a pay stub looks like. However, a paystub generator can be used to create pay stubs that reflect payroll details.

What Is a Pay stub?

A paystub is also commonly known as a pay statement or paycheck stub. It is a document that shows how your employer has paid you for a specific period. A pay stub also shows the net earnings that remain after all deductions have been applied.

Knowing "What is a pay stub?" can help employees understand why pay stubs are issued to them for each pay period.

Also check:Free online paystub maker to easily generate your paystubs.

Why Pay Stubs Matter

Pay stubs are important documents for both employers and employees. Below is why a pay stub is important:

Record of an Employee’s Earnings and Payments

Pay stubs clearly indicate the amount an employee was paid during a specific pay period. These records enable employees to track their regular earnings, hours worked, and overtime hours. It also helps employees see their tax deductions in detail.

Tracking Employees’ Payments Accurately

Pay stubs provide a clear and organized record of wages paid during each pay period. They help employers keep a record of employee pay details.

Pay stubs also make it easier for employers to track taxes withheld and other pay stub deductions. It also helps track employer contributions, such as health insurance or retirement plans.

Issuing accurate pay stubs may help businesses resolve pay-related issues promptly. An AI paystub generator can help companies generate accurate pay stubs in minutes. This may help maintain transparent and reliable payroll records for small business owners and employers.

Proof of Income

Pay stubs are commonly used as proof of income. They clearly show how much an employee earns and how often they are paid.

A real pay stub example includes all the necessary information on a pay stub. Because this information comes directly from an employer’s payroll system, many organizations trust pay stubs as a reliable means of verifying income details.

Loans, Rentals and Financial Records

Pay stubs are often used when applying for a car loan, renting an apartment, or organizing personal financial records. Landlords and lenders frequently review paycheck stub details to determine whether an applicant is financially stable.

Many people also keep their own pay stubs for financial planning, budgeting, and as a record of employee pay over time.

What Information Appears on an Employee Pay Stub and How To Read It?

Below is the information typically found on a paycheck stub:

Employee's Information

This section includes:

Employee's full name

Employee ID number

The last four digits of the Social Security Number (SSN)

Employer Information

This includes:

Employer's name

Employer’s address

Employer Identification Number (EIN)

Read more:How To Find Employer Identification Number (EIN) - Simple Guide

Pay Period and Pay Date

The pay period is the time frame your paycheck covers. It shows the start and end dates for the days or hours an employee works. However, the pay date is the actual day you receive your money.

Gross Pay

Gross pay refers to an employee’s total compensation before any deductions are applied. This section also includes:

Hourly wages

Overtime

Bonuses

Commission

Taxes and Withholdings

Taxes and withholdings are compulsory deductions from an employee’s paycheck. These taxes withheld may include:

Federal income taxes

State income taxes

Local taxes

Social Security taxes, such as OASDI taxes

Read more:What Is OASDI Tax On Paycheck? OASDI Meaning, Limits, And Benefits.

Voluntary Deductions

Voluntary deductions are divided into two categories. They include:

Pre-Tax Deductions: These are a way to reduce income before tax rates are applied. These include health insurance and retirement savings. It also allows for deposits into health or flexible spending accounts. This deduction helps maximize benefits and minimize taxes paid.

After-Tax Deductions: They include contributions to a Roth-style retirement account. It also provides union dues, contributions to charitable organizations, and additional insurance.

Net Pay

Net pay, or take-home amount, is obtained by subtracting all these deductions from the gross pay. Net pay is the amount credited to an employee’s account after all deductions have been applied.

YTD Totals

Year-to-date (YTD) information is based on cumulative totals from the beginning of the year to the specified time. The year-to-date totals typically include:

Year-to-Date Gross Earnings: This is the total amount earned from January 1st up to the current date. It shows your progress toward achieving yearly income targets.

Year-to-Date Deductions: This tracks tax deductions, contributions to retirement accounts, and other benefits.

Year-to-Date Net Pay: It reflects the total amount of take-home pay for a given year. The YTD net earnings can be compared with expenses throughout the year.

Read more:What Does Ytd Mean On A Check? A Complete Breakdown

Pay Stub Examples: What Does a Real Pay Stub Look Like?

If you are asking “What does a pay stub look like? “ these examples of pay stub will give you an idea.

Basic Pay Stubs

Basic paystub templates display basic information found on a pay stub, such as the employee’s information, the pay period, and gross pay.

Example of a Paystub for Hourly Employees

Hourly pay stubs indicate the number of hours worked and the employee's hourly wage. It is usually given to employees who earn wages or work at an hourly rate. It also shows any overtime or bonuses the employee has earned.

Salary Pay Stub Example

A salary pay stub displays the earnings and deductions for employees who are paid at a fixed rate. These pay stubs are often issued to salaried employees. It shows the gross pay, net pay, tax deductions, and YTD totals. It also indicates any extra income earned during the pay period.

Commission Paystubs Example

A commission pay stub gives a detailed statement of the total commission earned by an employee. It also shows how the employee's commission was calculated in detail.

Incentive or Bonus Paystub Examples

These pay stubs indicate extra pay on wages and salary. Incentives could result from an employee meeting a set goal or from improved performance.

Direct Deposit Pay Stub Example

Direct deposit pay stubs are sent to employees electronically, rather than on paper. The employee can then print these pay stubs.

Also check:Paystub templates to create your pay stubs in minutes.

When Are Pay Stub Images Required for Verification?

Below are situations where institutions require pay stubs to confirm earnings:

Employers may request an employee's pay stub during the onboarding process.

Government agencies may request pay stub information to assess eligibility for government benefits.

Financial institutions also use pay stubs to verify income or employment.

In most cases, you’ll be asked to submit pay stubs from a specific pay period, especially if income consistency matters. It’s important to note that it is illegal to make fake paystubs. Submitting fake paystubs can result in severe legal and financial consequences. Both the employer and the receiving organization may verify income through payroll services or an online payroll system.

The Bottom Line

Paystubs are important tools for both employees and employers. They provide a breakdown of employees' earnings, deductions, and net pay. By reviewing real pay stub examples, individuals can better understand their pay and maintain organized financial records. It can also help employees track taxes withheld.

Want to see what a paystub looks like? Generate a pay stub in minutes with our check stub maker. It is fast, easy, and reliable.

Our customer support is available 24/7:

Our customer support is available 24/7: