What Is A Check Number On A Pay Stub? And Its Importance

A check number on a pay stub is a unique tracking identifier usually assigned to each paycheck. It is issued by a company's payroll department and appears on employees' pay stubs. This number serves as a reference point for every payment, and it helps both employees and employers track earnings. With this paycheck number, they can also verify deposits and maintain organized financial records.

Through this guide, you'll be able to understand exactly "What is a check number on a pay stub?" It also explains where to find the check number on different types of pay stubs, and why it's important. Pay records created with a paystub generator typically show the check number near the top or in the payment details section.

- What Is a Check Number on a Pay Stub?

- Where Can You Find the Check Number on a Pay Stub?

- Why Your Paycheck Number Is Important

- Check Number vs. Other Numbers on Your Pay Stubs: Employee, Routing and Account Numbers

- What To Do if Your Pay Stub Has No Check Number

- How To Use Your Payroll Check Number To Verify Your Pay

- Final Thoughts

What Is a Check Number on a Pay Stub?

A check number is a unique reference number that a company's payroll department assigns to each payment it issues. A simpler way to describe it is that it's like an ID tag for your salary. A check number can also be called a Deposit ID, or Payment Ref.

Most systems started with using a paper check or cheque number on pay stub. In every check, there's a number that helps you track the money you spend. Now that payroll is mostly digital, employers also include a digital tracking number to identify a specific payment. It helps employees avoid errors and make sure the correct amount goes to the right person.

How Check Numbers Are Assigned for Every Pay Period

Most companies assign check numbers in order. For example, your first paycheck might be 1001, the next 1002, and it goes like that. Especially for small businesses, it makes it easy to see how many paychecks have been issued in a pay period and to whom.

Read more: What Is a Void Check and How to Obtain One?

Where Can You Find the Check Number on a Pay Stub?

To read a pay stub check number, it depends on whether your stubs are printed or digital:

Printed Pay Stubs

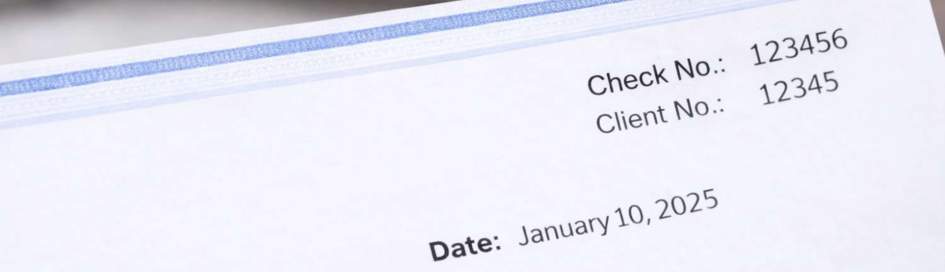

If you get a physical or printed check stub, check the upper right corner. It is close to the pay period dates and the company name. Mostly, it is labeled as "Check," "Cheque No.," or "Payment Ref." It's typically a short series of digits.

Digital or Electronic Pay Stubs / Direct Deposit

For direct deposit, your digital pay stub will still have this number. Check near your gross pay and net pay summary. On the pay stub, look for terms like "Deposit ID," "EFT Number," or even just "Check #." It might be a mix of numbers and letters.

You should know that certain payroll templates are different. So, if you can't find the check number, scan the whole document and check other areas to see if you'll find it. For example, check the header, the payment summary section, or the footer.

Why Your Paycheck Number Is Important

Here's why it's important for both employees and employers:

1. Payment Tracking and Verification

A check number is like a receipt. It proves that a specific payment for a specific pay period was issued. In a case where a deposit goes missing, the payroll department or bank can use this number to locate the transaction.

2. Record Keeping

Check numbers can help employees organize pay stubs chronologically, especially since they need pay stubs for their taxes or as proof of income. Since each pay stub has a unique reference number, they're easy to find.

3. Detects Errors

There may be situations where an employee's deposit in their bank account doesn't match their net pay on their pay stub. The best way to catch the error is by using the check number to identify where the error is.

Also check: Pick a template from our list of free pay stub templates to create accurate stubs.

Check Number vs. Other Numbers on Your Pay Stubs: Employee, Routing and Account Numbers

A pay stub usually has several numbers included in it, so it's easy to get confused and mix them up. That being said, let's explain these numbers.

Check Number vs. Routing Number

A routing number has to do with the bank. It's a 9-digit code that identifies the specific bank where your account is. Often, banks use different routing numbers for different types of transactions, such as checks, ACH, and wire transfers. Therefore, the check number on a paper check might not be the correct one for electronic payment transfers. It's important that you verify this with your bank.

Check Number vs. Employee Number

Employee number is also known as an employee ID. It's an employee's personal identifier within the company's HR system. For as long as they work in the organization, they should have an employee number. Employees use this number to log in to their company or payroll portal and access pay stubs, benefits, and work schedules.

Employees' IDs are always the same, and they never change. It's unlike a check number where there's no same check number; there's a new one for every payday.

Check Number vs. Account Number

An account number is the unique identifier for your personal bank account. It doesn't change, and it's used to identify where your funds are deposited.

For a check number, it is only specific to a single payment, and it changes with every paycheck a worker receives. It simply tracks the payment.

Read more:What Does Ytd Mean On A Pay Stub? A Clear Guide.

What To Do if Your Pay Stub Has No Check Number

Some basic payroll templates don't include a check number. However, don't worry about this, we'll explain what to do:

1. Ask Your Employer

Reach out directly to your manager, HR, or the payroll department of your company. Request them to provide the check or payment reference number for the particular pay you want.

2. Use Other Details to Verify

If there is no number, it is still possible to check the payment. The net amount and the pay date on the pay stub should match the amount deposited in the bank.

Also check:Paystub maker to create accurate paystubs within minutes.

How To Use Your Payroll Check Number To Verify Your Pay

Here are simple ways to use your cheque number on pay stub to verify that your pay is correct:

Deposit must match your net pay: When you receive your pay stub, check the check number and net pay. Then find the deposit for that number. It should match the net pay amount.

Check Your Bank: Log into your bank account and look for the recent deposit. Many banks usually list the check number or deposit reference in the transaction details. So, verify that the number and the payment amount match your stub.

Review Dates: Ensure that the pay period dates on your pay stub match the work you did. You shouldn't just rely on a check number. Check your gross pay, tax deductions, and dates to verify as well.

If the expected deposit isn't in your account, contact your payroll department or HR for assistance on this issue.

Also read: What If My Employer Doesn’t Provide Pay Stubs?

Final Thoughts

Now you know "What is a check number on a pay stub?" It's important to understand the number thoroughly. This helps in verifying pay, organizing employee records, and checking for any errors or issues with payments. Therefore, it gives you more control over your earnings and allows you to track your finances.

Use our paystub maker to create your pay stubs with accurate check numbers. Our tool creates pay stub documents that are useful for organizing records and providing accurate proof of income. Visit us now!

Our customer support is available 24/7:

Our customer support is available 24/7: