Finding Your Check Number Location

Paper checks are still in use today despite how online transfers, mobile payment apps, and digital banking are now popular.

Many people and organizations continue to rely on checks to pay their rent or settle business transactions. They find it to be a trusted and verifiable way to move money.

Looking at it at first glance, the numbers at the bottom of a check may look like random numbers. However, each set has a specific purpose. When people set up direct deposit details in a check stubs maker, they typically copy the routing and account numbers directly from these same lines on their checks.

Therefore, knowing the check number location, the check routing number location, and the check account number location can save you from being confused.

In this article, we'll break down how to read these numbers, their specific location, and why they're important.

Understanding the Parts of a Check

A check is a legal financial document that tells the bank who's paying and who's receiving the money. It also tells them how much exactly is being transferred.

On the surface, you'll see familiar features like:

The date line

The payee line, which is where you write the recipient's name

The amount box, where you write the payment in numbers

The amount line, where you write out the amount

The memo line for notes

The signature line

These are features that most are very familiar with. However, the most important information is usually at the bottom of the check, containing the MICR line.

There are numbers printed in a different font and with magnetic ink. Apparently, when banks process checks, machines quickly read this MICR line. They use it to route the payment to the correct institution and account.

On this line, you'll find three sets of numbers:

The check number

The routing number

The account number

These numbers are separated by special symbols that help you and even machines identify them correctly. You, however, need to know the exact placement of these numbers. If you mix them up, your payments might end up getting delayed or even misdirected.

What Is a Check Number?

A check number is an important feature that is printed on every check. You can think of it as an identifier or serial number assigned to every check in your checkbook. Your check number usually has a unique number for each check.

The main purpose of a check number is to help you and your bank monitor your payments. For example, let's say you write several checks in a month. The check number allows you to record which was used for rent and which was for utilities. You'll also know which was for other expenses.

This prevents any confusion and makes it easier to balance your checkbook or verify payments on your bank statement. It also helps to prevent any duplicates. Once your bank has cleared a specific check number, you cannot reuse it.

Check numbers are usually short, mostly between three and four digits.

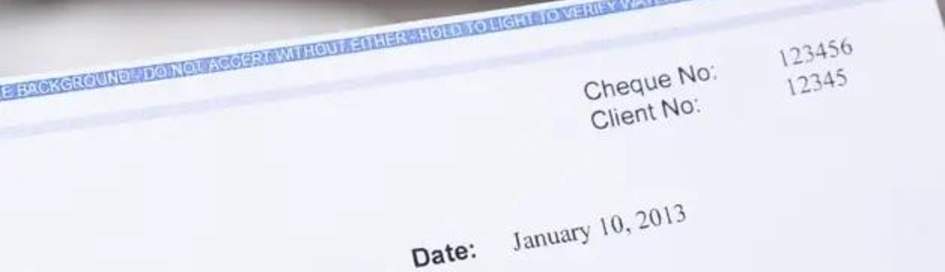

Check Number Location

You can usually see the check number location in two places. The first is in the top right corner of the check. It is printed clearly to help you reference it immediately. The second is on the MICR line at the bottom. Here, it typically shows as the last set of digits on the right-hand side.

The reason it appears in two places is that the top right version is for your own reference. Also, the MICR line version allows banks to process it electronically.

If you ever notice that the check number in the corner does not match the one on the bottom, that's a red flag. It could mean the check is altered or fraudulent, and you should contact your bank immediately.

What Is a Routing Number?

A routing number is a code that identifies a specific bank or credit union in the United States. You can think of this one as the bank's "address". It simply tells other banks where exactly to send or pull funds during a transaction. Your routing number is there to ensure that the money reaches the right bank.

Routing numbers can be used when setting up direct deposits for paychecks or making ACH payments. ACH payments can be automatic bill pay or online transfers. It can also be used when sending wire transfers for larger transactions. Without a check routing number, processing money securely between different banks would be impossible.

Check Routing Number Location

The routing number location on check is usually the first set of nine digits on its bottom left corner. You'll notice it comes before your account number and check number; this order is intentional. The bank must be identified before it can find your specific account.

Some larger banks may have multiple routing numbers. This depends on the state where you opened your account or the type of transaction you're completing. Smaller community banks, however, mostly use just one routing number.

What Is an Account Number?

An account number is a particular set of digits assigned to your bank account. It’s your personal number. It ensures that the money deposited, withdrawn, or transferred is linked directly to your account.

Most account numbers are usually within 8 to 12 digits. Some banks may use longer numbers depending on their internal systems. Your account number is specific to you, unlike routing numbers, which many customers of the same bank can share.

Check Account Number Location

On a physical check, you can find your account number in the middle of the MICR line at the bottom. The account number is usually between the routing number on the left and the check number on the right.

The check routing number and account number location are close together, so it’s easy to mix them up. You need to be able to identify them because an error can lead to delays or even misdirected payments.

How To Find Account and Routing Numbers Without a Check

If you don't have a checkbook, there are still several easy ways to find your routing and account numbers. Here are some of them:

Online Banking Portal

Log in to your bank's online platform using a web browser. Once you're signed in, go to the account details section. You'll find both your routing number and account number listed there. These are the same numbers you would use when entering direct deposit or bank details into a free paystub maker.

Mobile Banking App

Most banks have mobile apps that make it simple to access your account information. Open the app. Go to your account details. You’ll usually see your numbers clearly displayed.

Bank Statements

Your account number is in both your printed and electronic statements. The routing number may also be included in the bank's information section.

Customer Service or Branch Visit

Call your bank's customer service line if you prefer speaking with someone directly. You can also stop by a local branch. After confirming your identity, a representative can provide your account details.

Why You Need To Know Your Routing and Account Numbers

Your routing and account numbers greatly affect how smoothly your money moves. Here's why you need to know your routing and account numbers:

Smooth Transactions: When you enter the wrong digits when paying your bills or sending money, it can easily lead to failed payments. Therefore, you need to have quick access to the right numbers to help you avoid delays.

Fraud Prevention: Most scammers target financial details. If you know your numbers and check them often, you reduce the risk of sending money to the wrong account. You'll also avoid falling for fraudulent transfers.

Setting Up Payments: Whether it's payroll, IRS tax payments, or monthly utilities, most setups require both your routing and account numbers. If you don't have them, the process can be slow and even cause missed deadlines.

Bottom Line

Understanding the difference between the three unique numbers is highly useful. It helps you handle your finances better. Knowing where to find each of these on a check saves you from common mistakes. Small errors can sometimes cause significant issues, leading to even bigger risks. Also, you need to make sure that you handle these numbers carefully. Because they hold sensitive financial information, always double-check them before sharing. Only provide them through trusted, official channels. All of these make it easier to always maintain proper security.

Just like the check, routing and account numbers make transactions accurate, reliable documents and well-organized records make managing your money easier. Use our free AI pay stub generator to create professional stubs in minutes and stay on top of your finances. Our customer support is available 24/7:

Our customer support is available 24/7: