What Is A Year-End Paystub? W-2 Vs Last Paystub For Taxes

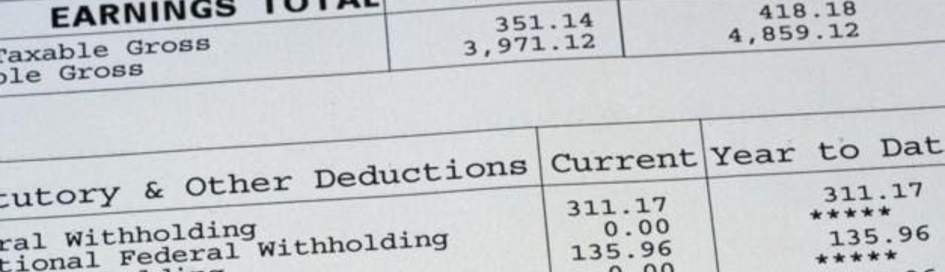

Wondering "What is a year-end paystub?" A year-end pay stub is the final detailed earnings statement employees receive from their employer for the calendar year. It summarizes their last pay period, also including the total annual gross pay, deductions, and net income. While a pay stub is an important financial and personal record, it's not the same as a W-2 form.

Oftentimes, this document confuses different employees, especially when it's tax season. Many of them look at both documents and think, "Can I use my last check stub instead of a W2?" This is especially true if W-2s aren't available yet. Last pay stubs are useful for personal record-keeping of your finances. A paystub generator is available online if you need to create pay stubs easily.

We'll explain both documents so you can understand them clearly. You'll be able to understand "What is a year-end paystub?" and how it works together with a W2 form.

What Is a Year-End Paystub vs a W-2?

A year-end pay stub is mostly known as a final pay stub or last paycheck stub. It is the last detailed earnings statement an employee receives for the calendar year. A simpler way to describe this document is that it is a grand total of your weekly or bi-weekly pay stubs. It simply itemizes everything for that specific final pay period. This includes an employee's:

Gross pay, which is their total earnings right before any amount is taken out.

All tax deductions and other withholdings. For example, federal income tax, Social Security tax, Medicare wage tax, health insurance premiums, and retirement plan contributions.

Net pay, the actual amount an employee finally takes home.

In this year-end pay stub, the most important component is your year-to-date (YTD) amount. It shows the running, cumulative total of an employee's gross earnings, including all deductions made. It calculates it right from the beginning of the year to your final paycheck. It's simply your annual summary, and usually, it's created through a payroll system.

Read more: W2 Deadline: Late Filing Penalties Employers Can Avoid

What Is a W-2 Form?

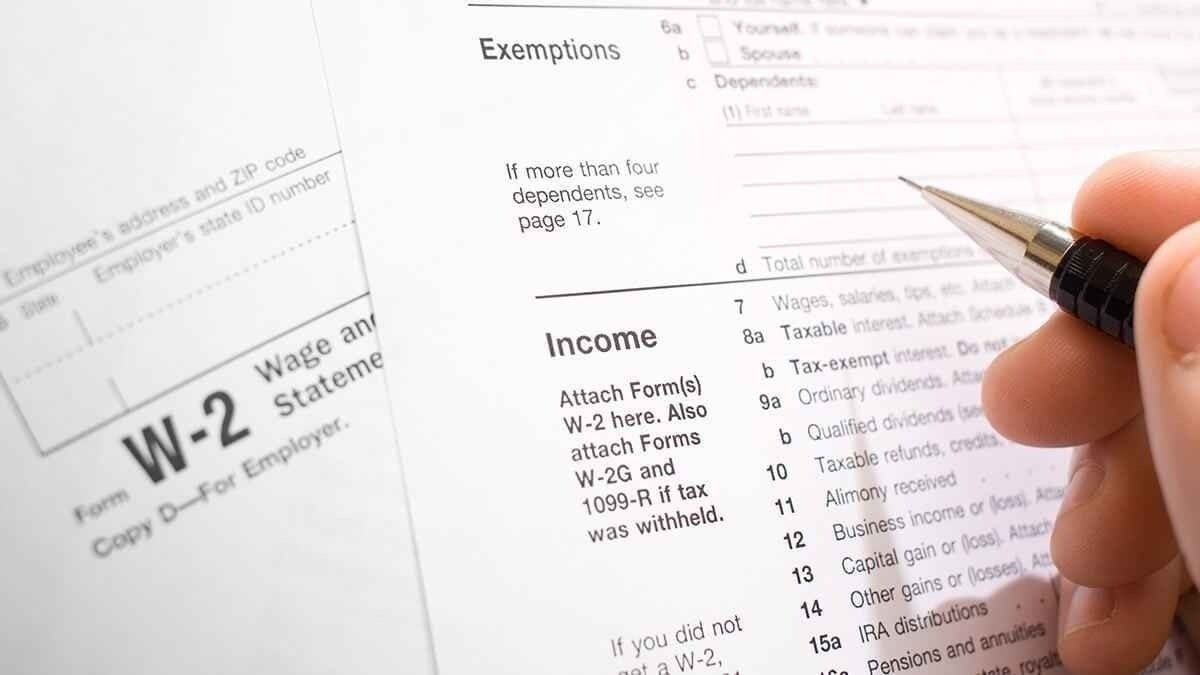

The Form W-2 is called a Wage and Tax Statement. It's completely different from year-end pay stubs. It is an official tax form that an employer is legally required to create and send to their employees. They must also send it to the Internal Revenue Service (IRS) by January 31st of every year.

One of the major purposes of this document is for employees to use it to report taxes. The W-2 form provides employees' annual summary of their taxable wages and the total taxes withheld over the entire year. It deducts all the non-taxable income items and accounts for pre-tax deductions. It then arrives at the taxable income figure that must be reported on their federal income tax return. The IRS uses this Form to match against your tax filing. Therefore, when it's tax season, it's necessary to report the W-2 Form.

W-2 Form vs Final Paycheck Stub

One of the first things to understand is the purpose they both serve. A year-end pay stub is a document useful for employee to track their finances, plan, and budget. It works for personal record-keeping, budgeting, and to verify that your paycheck details are correct. A year-end pay stub is also useful as proof of income. Usually, when applying for an apartment or needing a loan, you need proof of your current gross income.

On the other hand, the form W-2 is for the IRS and state tax authorities. It's for tax filing purposes. It officially reports employed wages earned and what was withheld for the tax year.

Typically, an employee receives a pay stub with every single paycheck, and the last one for the year is the year-end pay stub. However, employers only issue a Form W-2 once every year. The employee's pay stub includes every amount paid, including non-taxable income, like reimbursements or dependent care benefits. Taxable income refers to your gross pay after subtracting all pre-tax deductions. This includes things like company health insurance and retirement plan contributions.

Lastly, while employers are legally mandated to send Form W-2 to their employees, it's not the same as pay stubs. There is no federal law that mandates employers to provide pay stubs, but they should maintain accurate records. Many states require it.

Also check: Do you need to create pay stubs? Choose a pay stub template here.

Differences Between a W-2 Form and a Final Pay Stub

As we've explained, W-2s and year-end pay stubs are separate documents, so it's possible to have different numbers on them. They both contain employee earnings. One would then wonder why they end up having different amounts. Here's why:

1. Pre-Tax Deductions (Health Insurance, Retirement Plan, FSAs)

Pre-tax deductions are the amounts you choose to have taken from your gross pay before your taxes are calculated. Pre-tax deductions include premiums for company health insurance, contributions to retirement plans. For example, 401(k) or 403(b). It may also include your deposits into Flexible Spending Accounts (FSAs) for healthcare or dependent care.

Pre-tax deductions lower taxable income. They usually appear as line-item deductions on pay stubs, and this reduces your net pay. This refers to net pay that's less than the amount contributed. On your Form W-2, they have already been subtracted.

Let's say an employee's gross pay for the year was $60,000. $5,000 was contributed to a 401(k) and $3,000 to pre-tax health insurance. It would show $60,000 in gross earnings on the pay stub YTD. However, Box 1 of the Form W-2 will report taxable wages as $52,000 ($60,000 - $8,000).

2. Non-Taxable Income Items and Reimbursements

Your job may involve having expenses that the company reimburses later. These can be business expenses reimbursements for mileage, travel, client meals, or required tools. These are non-taxable incomes.

These reimbursements are usually included in the gross amount on pay stubs, and this increases total earnings. However, they are non-taxable income items. So they aren't included in taxable wages reported on W-2 forms if the company uses an accountable plan.

3. Pay Period vs Tax Year

The payroll timing is also a major difference. The IRS requires employers to report income in the tax year it was paid. It's not necessarily when it was earned. Most companies have a pay period that ends in December, but they process and pay in early January. So, the paycheck will be included in the gross earnings on the year-end pay stub.

It's for your work done in December. But since you received your pay in January, it's automatically for the new tax year. Therefore, it wouldn't appear on the current Form W-2, but next year's.

4. Taxable Fringe Benefits

Some benefits are taxable. For example, using company vehicles, group term life insurance coverage, or a gym membership covered by the company.

Most times, these benefits aren't listed as a separate line item on your regular pay stub. Although some employers list them regardless. However, employers are required to calculate them. They'll then add them to your taxable income for the year. This increases the number in Box 1 of your W-2, without increasing your last pay stub's YTD gross pay figure.

5. Social Security Tax Wage Base Limits

The annual cap on earnings subject to Social Security tax is $184,500. Once the employee's year-to-date earnings hit this amount, they stop paying Social Security tax for the rest of the year.

Your pay stub continues to show their normal gross wages all year. However, box 3 Social Security wages on a W-2 will stop once they reach that particular cap. Therefore, if you earned $200,000, your pay stub YTD still shows $200,000. But Box 3 of your W-2 will show only $184,500. On box 5, where Medicare wages are, it still has $200,000, not following the cap.

Read more: Employer Not Giving Pay Stubs? Here Is What To Do.

Can You File Taxes With Last Check Stub?

According to the Internal Revenue Service, this isn't possible. Most people think their last check stub can be a replacement for Form W-2. It's interesting to note that a pay stub is not a legal substitute for filing a tax return. A pay stub doesn't have the required data. For example, an Employer Identification Number (EIN). An EIN is required to file tax returns. It also doesn't include a detailed breakdown of taxable benefits and retirement plan contributions, both of which are required.

Another reason is that it usually doesn't reflect final adjustments. Most employers often make year-end adjustments for things like taxable fringe benefits or corrected bonus amounts. These adjustments definitely appear on the final W-2, but not the last check stub from December.

When an employee tries to file with a pay stub, the IRS will most likely reject the electronic return or delay their tax refund. There may also be inaccuracies in your amounts, which causes you to pay the wrong tax amounts. This may lead to penalties. Final pay stubs are, however, great for estimating a tax refund or tax due. While waiting for official W-2s to arrive, you can use YTD figures to fill out a preliminary tax return.

Further reading: What Are The Differences Between A Pay Stub Vs Payslip?.

Final Thoughts

Understanding "What is a year-end paystub?" and how it's different from a W2 form is necessary. For employees, both forms are extremely important, as they serve different purposes. A year-end pay stub summarizes total earnings for the year. It helps to track your overall finances. A W-2, however, is submitted to the IRS every year to report an employee's earned wages, and is useful for filing taxes. Knowing how terms like pre-tax deductions, non-taxable income, and other aspects of your document work can help to understand your forms better.

Employers trying to generate quick W2 forms can use our W2 generator. They can also check out our pay stub creator to generate accurate pay stubs. Our tools ensure tax compliance while creating employee documents. Visit us now!

Our customer support is available 24/7:

Our customer support is available 24/7: